Looking for an Auto Loan or want to become a Partner Dealer?

Visit KoraDriveFind creditworthy borrowers missed by credit scores with the power of AI

Kora automates income verification, detects fraud in real-time, and streamlines underwriting for auto lenders of all sizes.

Where traditional underwriting falls short, KoraConnect delivers

Faster originations, more approvals, & less risk

+80%

Approvals for thin-credit2

2 min

Or less to gather cash flow data3

100%

FCRA/BSA/AML Compliant

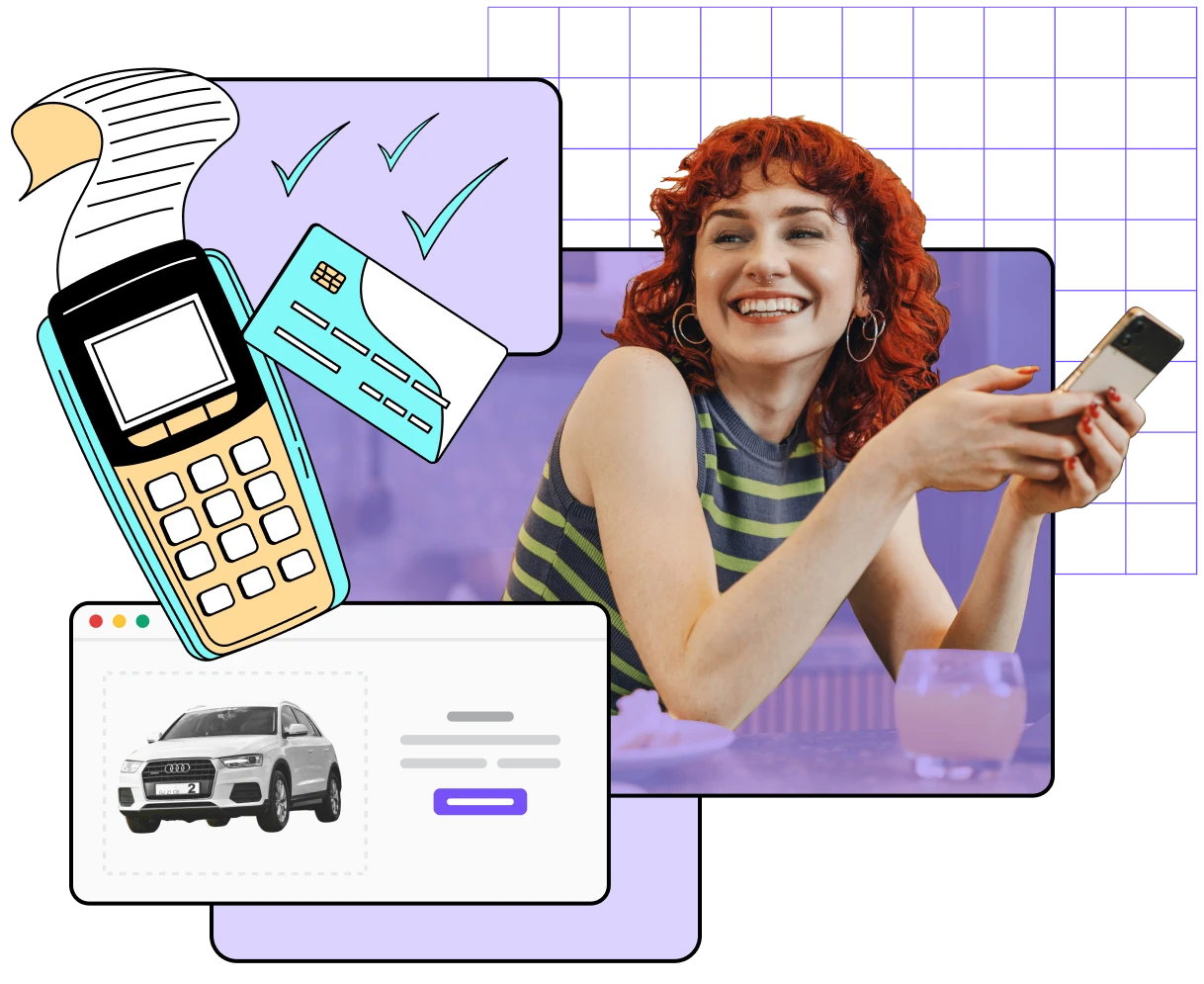

Dealers & Lenders

Close More Deals with Faster, Smarter Financing.

KoraConnect helps dealers and lenders close more deals with real-time income verification, AI-powered fraud detection, and instant underwriting decisions. Faster approvals mean more sales and higher profits.

- Approve more buyers instantly

- Detect fraud before funding

- Fund deals in hours, not days

Banks & Lenders

Lend Smarter with AI-Driven Risk Insights.

KoraConnect gives banks and lenders the power to make data-driven credit decisions, automate compliance, and reduce risk exposure. Scale your lending operations without sacrificing accuracy or efficiency.

- Make smarter credit decisions

- Automate fraud and compliance

- Seamlessly connect with your LOS

By lenders, for lenders

Over the past 10 years, our team has built the tools that helped us become a smarter, better-performing lender. Today, that same technology powers KoraConnect for lenders everywhere.