Enhance decisioning with the power of

cash flows and AI

Leverage artificial intelligence to analyze detailed cash flow data, enabling faster, more accurate credit decisions that adapt to your customers' financial realities.

Take advantage of our experience

originate thousands of loans with credit invisible applicants¹.

Underwriting and Decisioning

Transaction-Based Underwriting

Utilize machine learning to analyze thousands of customer transactions to build a comprehensive picture of applicants’ finances.

Lightning Fast Decisioning

Cutdown time spent in decisioning flows from hours or days to seconds.

Verification and Compliance

Income Verification

Aggregate multiple sources of cashflow data to create a comprehensive picture of applicant income.

Cutting-Edge Compliance

As a lender ourselves, our Enterprise decisioning and underwriting flows meet rigorous bank-grade standards, ensuring they fulfill even the most stringent requirements.

Enhance Traditional Fraud Prevention and KYC

Enhance Traditional Fraud Prevention and KYC

Verify Personal Information

Automate Facial & ID verification, IP network scanning, phone number analysis, OFAC checks, and more.

Bank Statement Verification

Kora partnered with Resistant.AI to ensure that bank statements haven’t been manipulated.

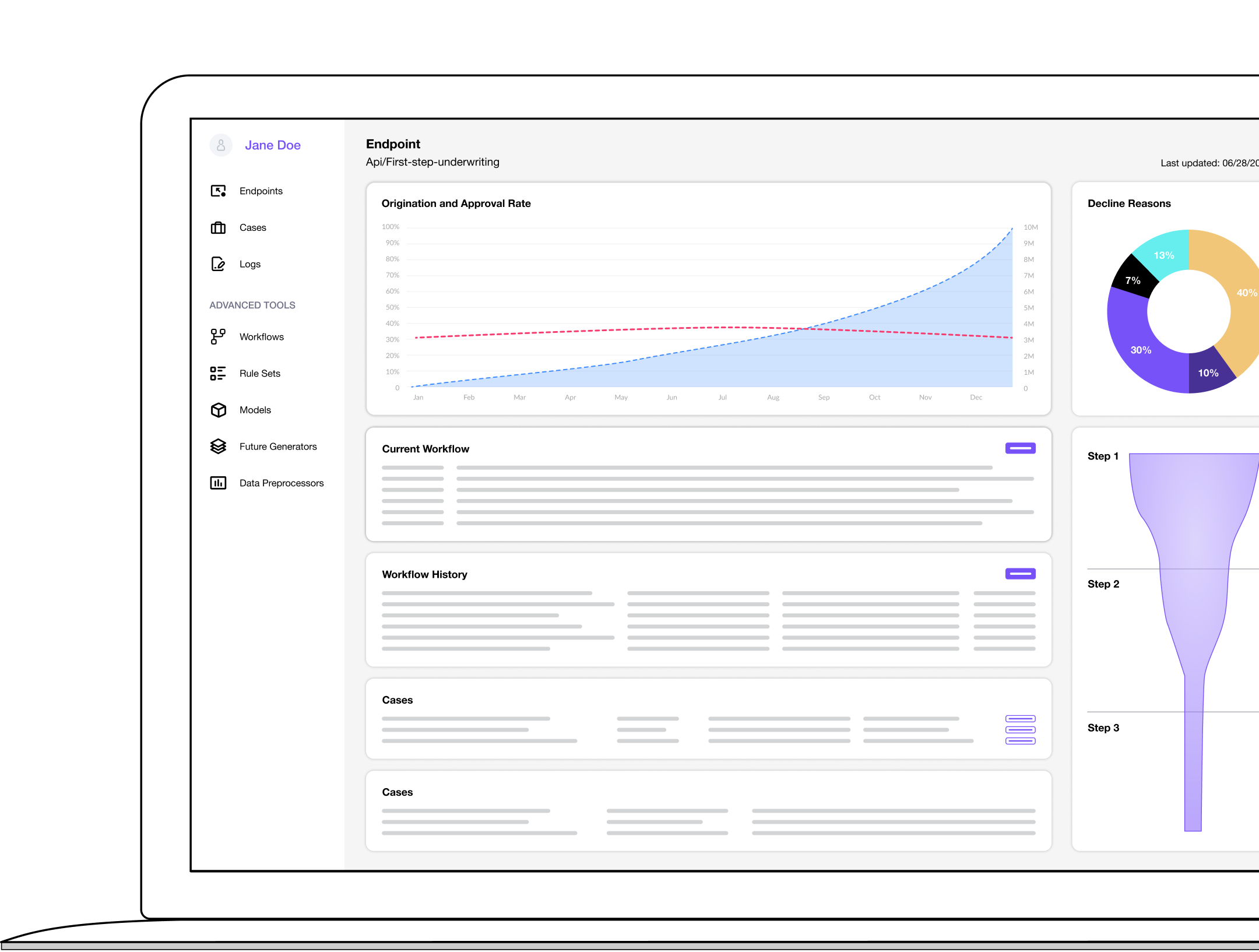

Portal for Real Time Intelligence

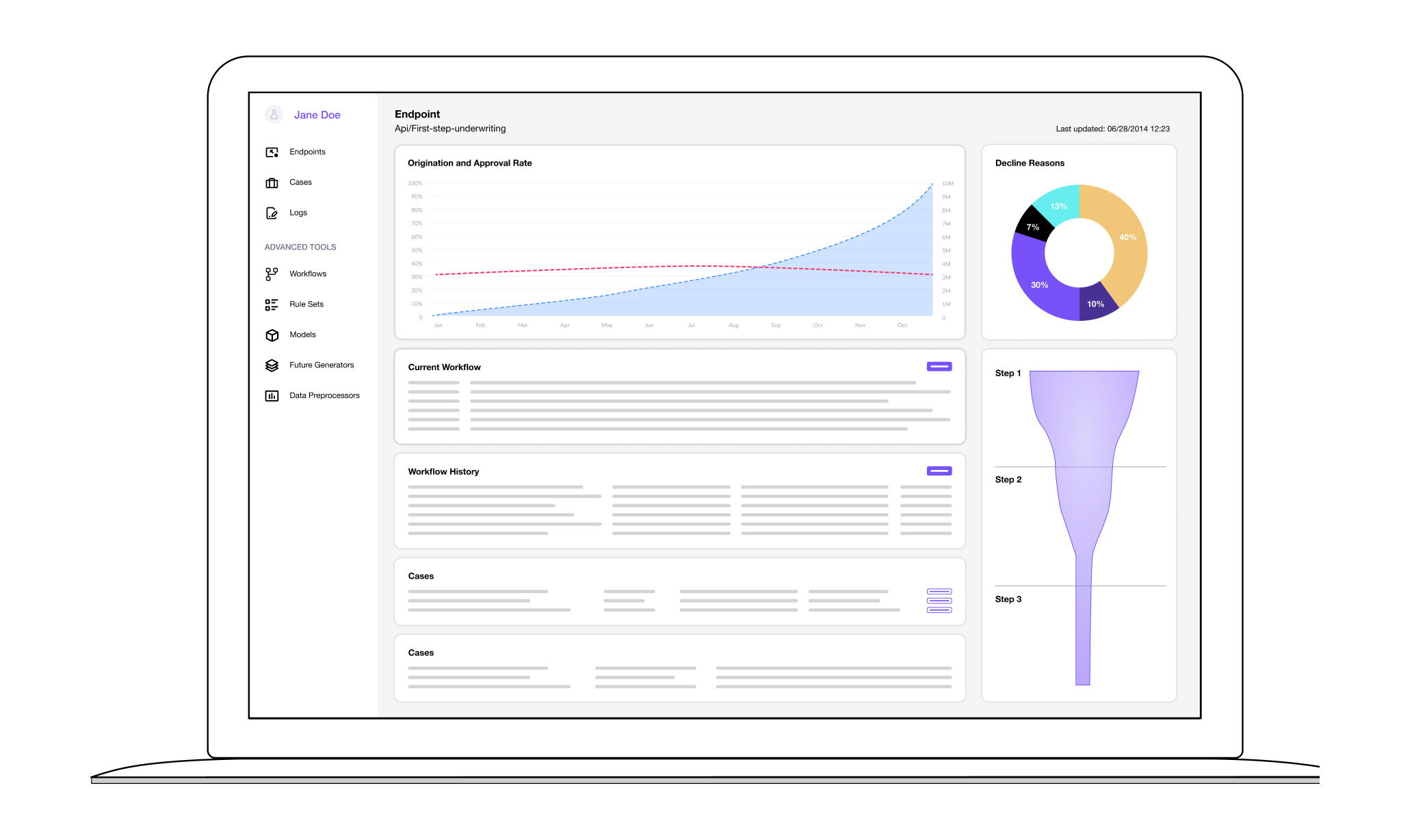

Real-Time Analytics Dashboards

Track application volume, approval rates, and decision times through intuitive visualizations.

Customize your view to focus on what matters most to your business, and make informed decisions with data that’s always up-to-date.

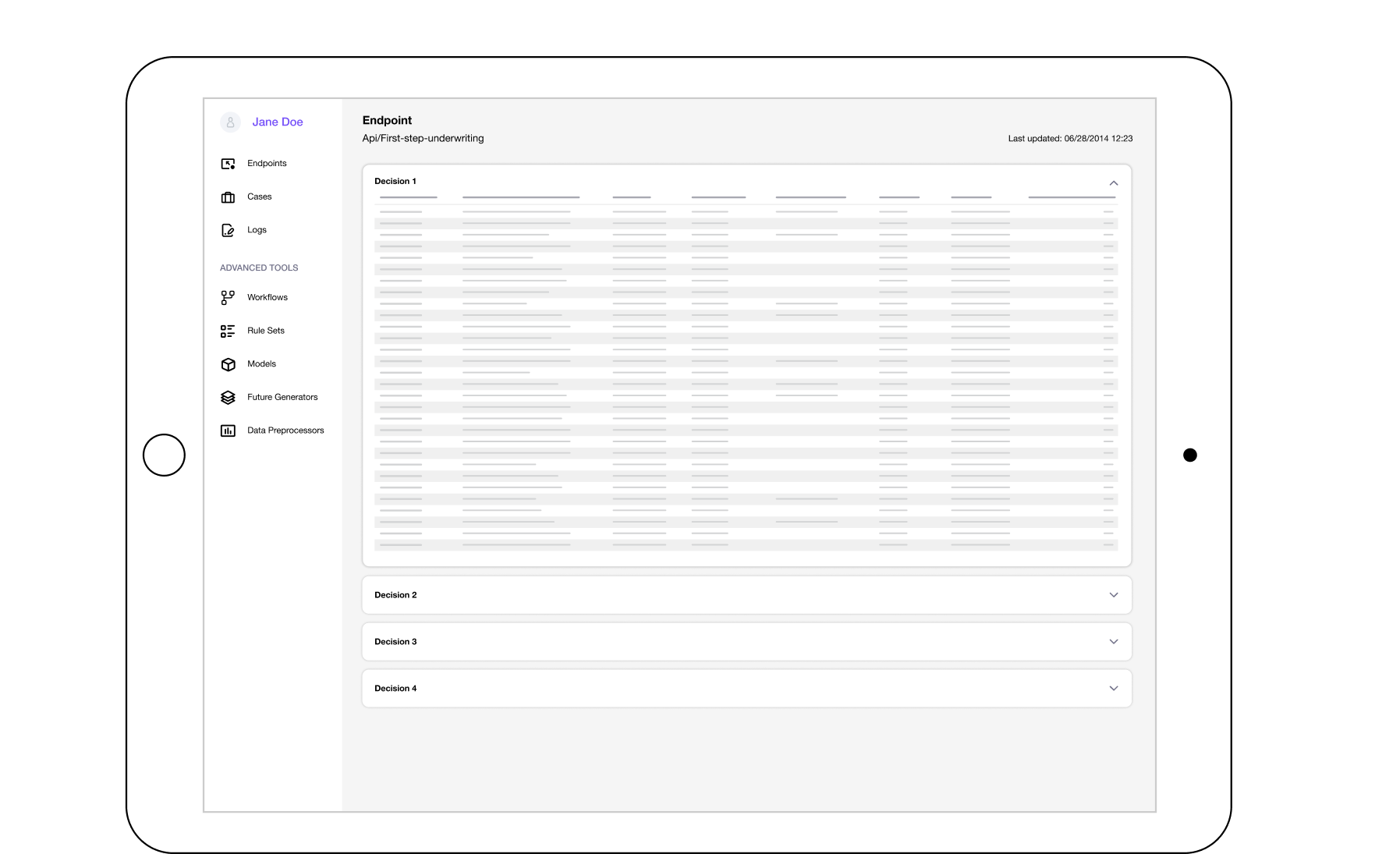

Access In-Depth Reports With Just a Click

Detailed logs on each decision and breakdowns of influencing factors like credit assessments and income verifications.

Downloadable in multiple formats, our reports are ready to help you with everything from daily operations to regulatory compliance.

Customizable Alerts and Notifications

Receive instant alerts for critical updates and changes, tailored to your specific needs and preferences.

Stay on top of your underwriting processes and respond quickly to surges or platform updates, ensuring smooth operations and timely responses.

Development Tailored to Your Needs

- Whether you're a small mortgage lender looking for an edge or a large institution seeking more depth, Kora can design integration plans that optimize your decision-making process.

- Enhance your operational efficiency with Kora's tailored integration solutions, suited to both small lenders and large institutions.

Dedicated Management and Support

- Leverage our dedicated management and support for your fraud prevention and KYC initiatives, from initial setup to ongoing operations.

- Benefit from our expert team's specialized product knowledge, ensuring continual success and strategic alignment in fraud prevention.