Discover more creditworthy borrowers with Cash Flow Analysis

Reduce portfolio risk, confidently approve more deserving applicants, and significantly improve overall portfolio performance.

Cash Flow Analysis

Turn Raw Data Into Real Insights

KoraConnect transforms raw transaction data from bank connections and bank statements into meaningful insights that can be used in decisioning and pricing.

Test with your data

KoraScore

Predicts the likelihood of default based on comprehensive cash flow analysis. Customizable scoring models are also available to align with your specific user segments and risk appetite.

Models

Charge-off Model

Predicts the likelihood of a loan resulting in a charge-off.

Early Default Model

Predicts the likelihood of an account becoming 60+ days past due.

Risk Indicators

Automatically identify and flag potential risks such as overdrafts, late fees, unidentified loans, income instability, low balance trends, and significant one-time expenses.

Configurable decision rules according to your risk policy with automation

Full list of indicators focusing on affordability, willingness to pay and hidden risk from transaction patterns.

Income & Debt Verification

Pinpoint income and debt with clarity.

Key Features

Income Stability

Detect irregular and non-traditional income like freelance, gig work, variable pay, and removes noise from internal transfers, cash advances and loan disbursements.

Hidden Debts

Detect hidden debt obligations like BNPL, unreported loans, and 3rd party payments. Deliver a comprehensive view of applicant's liabilities for accurate risk assessment.

Synthetic Income Inflation

Identify artificial deposits into accounts with closed-loop transfers and mismatched deposit origins.

Income and Employment Falsification

Verify frequency and stability of deposits to identify actual recurring incomes.

Fraud Detection

Proprietary models trained on real transaction data that surface fraud signals across documents and bank activity.

Types of Fraud

Identity

Compare extracted account ownership details (name, address, joint account ownership) to loan applications.

Manipulated Documents

Detect PDFs that have been altered with image overlays to hide or inflate values, or that appear to be synthetically generated by AI.

Income and Employment Falsification

Detect payroll and deposit manipulation that can be used to inflate income and ability-to-repay.

Account Info Reconciliation

Automatically review bank statements to see if transactions and balances have been manipulated.

KoraScore

Predicts the likelihood of default based on comprehensive cash flow analysis. Customizable scoring models are also available to align with your specific user segments and risk appetite.

Models

Charge-off Model

Predicts the likelihood of a loan resulting in a charge-off.

Early Default Model

Predicts the likelihood of an account becoming 60+ days past due.

Risk Indicators

Automatically identify and flag potential risks such as overdrafts, late fees, unidentified loans, income instability, low balance trends, and significant one-time expenses.

Configurable decision rules according to your risk policy with automation

Full list of indicators focusing on affordability, willingness to pay and hidden risk from transaction patterns.

Income & Debt Verification

Pinpoint income and debt with clarity.

Key Features

Income Stability

Detect irregular and non-traditional income like freelance, gig work, variable pay, and removes noise from internal transfers, cash advances and loan disbursements.

Hidden Debts

Detect hidden debt obligations like BNPL, unreported loans, and 3rd party payments. Deliver a comprehensive view of applicant's liabilities for accurate risk assessment.

Synthetic Income Inflation

Identify artificial deposits into accounts with closed-loop transfers and mismatched deposit origins.

Income and Employment Falsification

Verify frequency and stability of deposits to identify actual recurring incomes.

Fraud Detection

Proprietary models trained on real transaction data that surface fraud signals across documents and bank activity.

Types of Fraud

Identity

Compare extracted account ownership details (name, address, joint account ownership) to loan applications.

Manipulated Documents

Detect PDFs that have been altered with image overlays to hide or inflate values, or that appear to be synthetically generated by AI.

Income and Employment Falsification

Detect payroll and deposit manipulation that can be used to inflate income and ability-to-repay.

Account Info Reconciliation

Automatically review bank statements to see if transactions and balances have been manipulated.

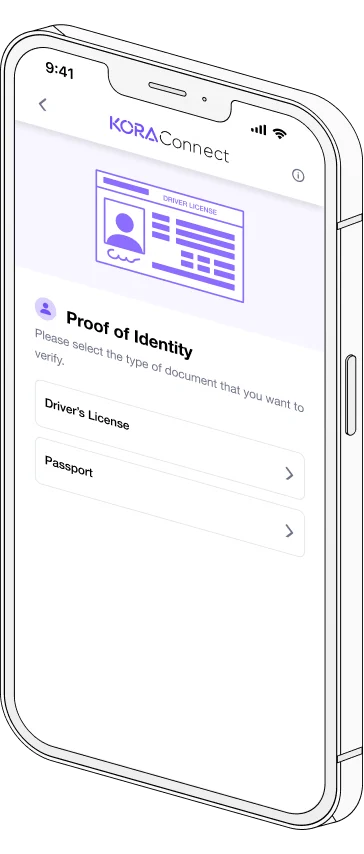

Verification

Verify Everything You Collect

KoraConnect verifies the key information behind every application, giving lenders cleaner, more consistent verifications that reduce manual review and enable faster, more confident decisions.

Talk to our team.Bank Statements

Confirm statements are authentic and unmanipulated.

Identity

Confirm the applicants' identity across bank data, documents, and ID.

Employment

Detect unique income streams to verify employment.

Who We Serve

Cash Flow Underwriting for All Lenders

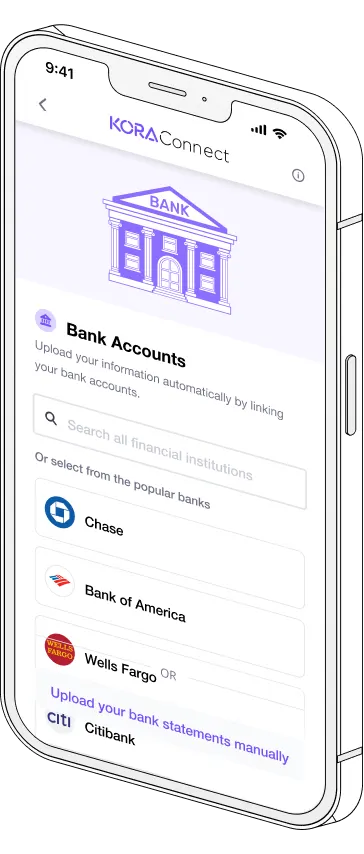

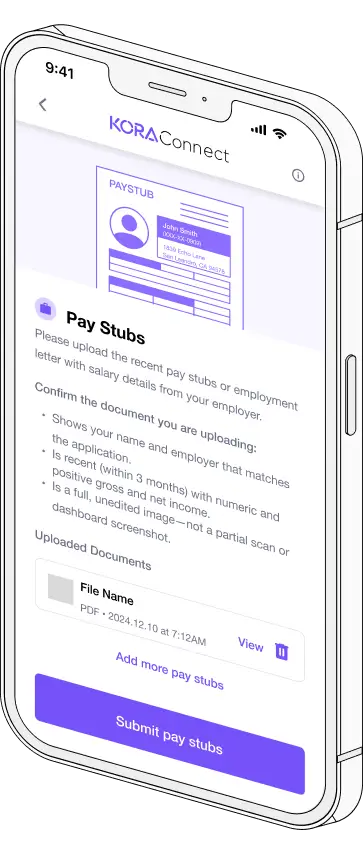

KoraConnect brings cash flow underwriting to any lending workflow. Use the applicant portal as a standalone link or embedded experience, or send documents like bank statements and paystubs via API for analysis and decision-ready outputs.

Why lenders choose KoraConnect

Proven, field-tested, and purpose-built for lenders by lenders

With 8 years of auto loans, personal loans, installment loans, and card-related financing experience, our modal is trained on extensive data from our own portfolio and lending partners.

Approval Rate for No-Hit / Thin-File Applicants

Net Lift per Application by adding rules based review of financial behaviors

As observed in KoraConnect "Grow Origination & Avoid Losses"

Average time it takes for an applicant to connect a bank account or upload statements in the KoraConnect portal

Integration

True, comprehensive picture of borrowers financial health

KoraConnect fits into your underwriting workflow via APIs or underwriter dashboards, and applicants can use it through a standalone portal link or an embedded web view.

Schedule a demoIntegrate via API

KoraConnect's cash flow analysis (including KoraScore and Risk Indicators) can be integrated with automated decisioning engines.

RESTful API

Sandbox Environment

Identical Data Available via API and Dashboards

Interactive Dashboards

Underwriters can also review cash flow findings and risk indicators on KoraConnect's web based dashboards.

Role-Based Access Controls

Customizable Dashboard Views

Embed or Share URLs

Loan applicants can connect bank accounts and upload documents through the KoraConnect portal, available as a standalone link on its own URL or embedded directly in an existing application.

Webview within existing applicant flows

Applicants can go through KoraConnect

Results will be available both as dashboard or API

Customization & Branding

Multi-Language Support

SOC 2 Certified

Kora is proudly SOC 2 Type 1 certified. Reports are available for clients upon request.

Free Retroactive and Backtesting

Run a complimentary retrospective analysis to quantify how KoraConnect would have impacted risk outcomes across your recently funded portfolio.

Compliance

Use New Data, Maintain Compliance.

Using new data for decisioning and pricing does not have to create new compliance headaches. KoraConnect's cash flow insights are designed to fit cleanly into your existing underwriting models, policies, and decisioning infrastructure.

FCRA Compliant

Consumer permissioned data keeps cash flow underwriting compliant with the Fair Credit Reporting Act.

Adverse Action Support

KoraConnect even has adverse action reasons that you can adopt to decisions based on cash flow data.

Get started with KoraConnect.

Talk with our team to learn how other lenders are leveraging KoraConnect for cash flow underwriting.